PDF ISBN 978-92-9473-211-8 doi:10.2854/069800 EI-02-19-509-EN-N

Print ISBN 978-92-9473-212-5 doi:10.2854/86236 EI-02-19-509-EN-C

Luxembourg: Publications Oce of the European Union, 2019

© EIOPA, 2019

Reproduction is authorised provided the source is acknowledged.

For any use or reproduction of photos or other material that is not under the EIOPA copyright,

permission must be sought directly from the copyright holders.

CONSUMER PROTECTION

ISSUES IN TRAVEL

INSURANCE:

A THEMATIC REVIEW

CONTENTS

EXECUTIVE SUMMARY

INTRODUCTION

METHODOLOGY

. OVERVIEW OF TRAVEL INSURANCEMARKET

1.1. General overview 13

1.2. Travel insurance products 15

1.3. Financial ratios in travel insurance 16

1.4. Commission levels in travel insurance 18

1.4.1. Bancassurance 18

1.4.2. Insurance agents/brokers 19

1.4.3. Ancillary insurance intermediaries 20

1.4.4. Comparison websites/aggregators 21

1.5. Claims ratio 22

1.6. Denied claims 24

. BUSINESS MODELS

2.1. Changes in the business models 26

2.2. Digitalisation and innovation - the drivers for change 27

2.3. New digital distributors of travel insurance 28

2.4. Emerging business models – Big Tech entering the market 29

2.5. Risks for distributors not integrating new digital models 30

. IDENTIFIED ISSUES IN PRODUCT DESIGN

3.1. Product complexity 31

3.2. Terms and conditions- transparency and disclosure 32

3.3. Product diversity and product standardization 33

3.4. Pre-existing medical conditions 34

3.5. Over-insurance and double insurance 36

3.6. Premium calculation – factors considered 38

EUROPEAN INSURANCE AND OCCUPATIONAL PENSIONS AUTHORITY

2

. DISTRIBUTION AND SALES PROCESSES

4.1. Cross selling and add-ons 40

4.1.1. Consumer behaviour with add-on insurance 42

4.1.2. Online distribution: impact on and risks for consumers 43

4.2. Changing distribution channels 45

4.3. Issues with tenders for online distribution 46

4.4. Sales practices 47

. COMPLAINTS

. CONCLUSIONS AND NEXT STEPS

ANNEX I REGULATORY FRAMEWORK

ANNEX II REPORTED CONSUMER PROTECTION ISSUES

ANNEX III GLOSSARY

ANNEX IV LIST OF ACRONYMS

CONSUMER PROTECTION ISSUES IN TRAVEL INSURANCE: A THEMATIC REVIEW

3

TABLE OF FIGURES

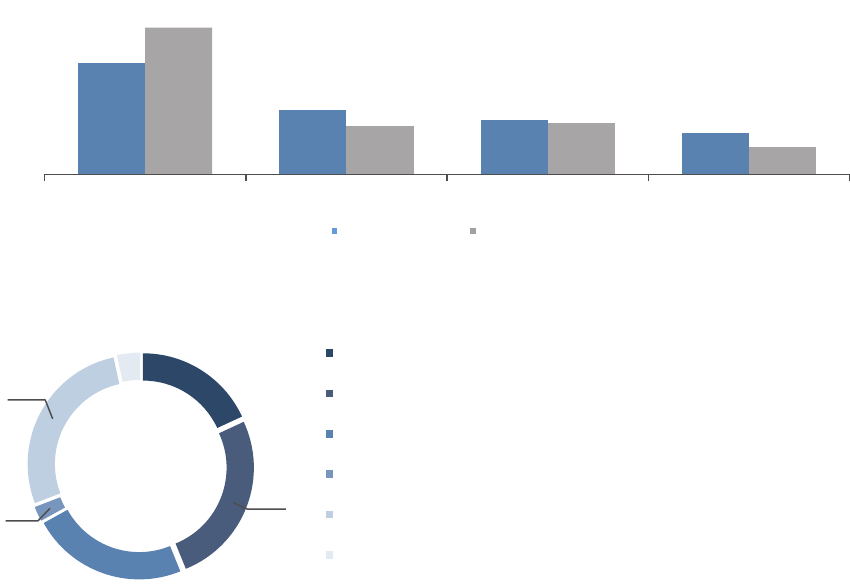

FIGURE GWP GROWTH IN THE EEA FOR VS

FIGURE EEA GWP GROWTH FOR ASSISTANCE VS NONLIFE IN

FIGURE AVERAGE COMMISSIONS IN THE EEA IN

THE NONLIFE INSURANCE

FIGURE COMMISSION LEVELS IN ASSISTANCE VS NONLIFE

FIGURE AVERAGE CLAIMS RATIO IN NONLIFE

INSURANCE IN VS

FIGURE AVERAGE CLAIMS RATIO IN NONLIFE INSURANCE IN

FIGURE NUMBER OF NEW POLICIES

FIGURE TRAVEL INSURANCE CUSTOMERS

FIGURE COLLECTED GWP FOR SINGLETRIP

AND MULTITRIP POLICIES

FIGURE AVERAGE FINANCIAL RATIOS IN TRAVEL

INSURANCE VS NONLIFE INSURANCE AS A WHOLE

FIGURE GWP SPLIT BY DISTRIBUTION CHANNEL

FIGURE AVERAGE COMMISSIONS AND CLAIMS RATIOS

FIGURE MAXIMUM COMMISSION LEVELS AND CLAIMS RATIOS

FIGURE AVERAGE COMMISSIONS IN BANCASSURANCE

FIGURE MAXIMUM COMMISSIONS IN BANCASSURANCE

FIGURE AVERAGE COMMISSIONS TO

INSURANCE AGENTS BROKERS

FIGURE MAXIMUM COMMISSIONS TO

INSURANCE AGENTS BROKERS

FIGURE AVERAGE COMMISSIONS TO ANCILLARY

INSURANCE INTERMEDIARIES

FIGURE MAXIMUM COMMISSIONS TO ANCILLARY

INSURANCE INTERMEDIARIES

EUROPEAN INSURANCE AND OCCUPATIONAL PENSIONS AUTHORITY

4

FIGURE AVERAGE COMMISSIONS TO COMPARISON

WEBSITESAGGREGATORS

FIGURE MAXIMUM COMMISSIONS TO COMPARISON

WEBSITESAGGREGATORS

FIGURE CLAIMS RATIO

FIGURE MEDIAN CLAIMS RATIOS PER DISTRIBUTION CHANNEL

FIGURE CLAIMS RATIOS

FIGURE TOTAL CLAIMS PAID PER COVER

FIGURE PROPORTION OF DENIED CLAIMS

FIGURE PROPORTION OF DENIED CLAIMS PER

DISTRIBUTION CHANNEL

FIGURE PROPORTION OF DENIED CLAIMS OUT

OF TOTAL CLAIMS PER COVER

FIGURE CHANGES IN BUSINESS MODELS

FIGURE APPROACH TO PRODUCT OFFERING

FIGURE PREEXISTING MEDICAL EXCLUSIONS

FIGURE PRODUCTS BUILT ON EHIC

FIGURE SINGLETRIP POLICY

FIGURE MULTITRIP POLICY

FIGURE PREMIUM VARIATION PER DISTRIBUTION CHANNEL

FIGURE PARTICIPATION OF INSURERS IN TENDERS

FIGURE NUMBER OF COMPLAINTS PER REASON

FIGURE MEASURE TAKEN AS A FOLLOWUP TO COMPLAINTS

CONSUMER PROTECTION ISSUES IN TRAVEL INSURANCE: A THEMATIC REVIEW

5

EXECUTIVE SUMMARY

The European Insurance and Occupational Pensions Authority (EIOPA) launched in 2018

a thematic review aimed at better understanding travel insurance products, to identify

potential sources of conduct risk and consumer detriment, so as to take relevant super-

visory actions if needed.

With economic recovery, in the aftermath of the financial crisis, coupled with decreasing

travel costs, travellers’ numbers have been growing each year. This has led to growth in

the travel insurance market.

Travel insurance has however been in the spotlight of supervisors in some European

countries given the specific conduct risks it entails, related to conflicts of interest arising

from mis-aligned incentives in distribution channels, consumer behaviour issues arising

in so-called ‘add-on’ markets, and consequential risks of poor value at the level of the

product oer. Travel insurance is mostly a ‘small-ticket’ business, but it can be critical

for consumers, since the impact of insucient cover or denied claims – in particular

for medical expenses while travelling – can be extensive at the individual level. Issues

around coverage, denied claims, unclear and conflicting terms and conditions have also

been highlighted in EIOPA’s engagement with stakeholders and input gathered in view

of reporting on consumer trends.

Moreover, the travel insurance sector is also facing important changes that may bring

opportunities whilst also heightening existing problems and bringing new risks. Insur-

ance undertakings have been integrating new technologies into their business models

leading to changes across the entire value chain, while new kinds of distributors have

entered the market. Particular concerns arise with regard to rising commissions, the

exploitation of behavioural biases when selling online travel insurance policies, and the

potential erosion of product value and features.

Some of the key findings of the thematic review are:

› The travel insurance market as a whole does not appear to face a general market fail-

ure, and travel insurance products remain valuable for consumers. However some

business models entail heightened conduct risks, including remuneration structures

based on very high commissions. This leads to consumer detriment.

› While the average commissions in travel insurance are around 24% of the gross

written premium (GWP), there are insurers that pay extremely high commissions to

distributors, of significantly more than 50% of the premium. (see Section 1.4)

› The average claims ratio is 40% of the GWP and there is limited dierence in the

average regardless of the distribution channel. However, there are very wide varia-

tions in these ratios; some insurers have claims ratios below 20% of the GWP. These

are a strong indicator of potential low value for consumers. (see section 1.5)

› New market players are entering the market, typically selling travel insurance prod-

ucts online as an ancillary activity (airline and ferry companies, price comparison

websites, aggregators, banks and supermarkets);

EUROPEAN INSURANCE AND OCCUPATIONAL PENSIONS AUTHORITY

6

› Partnerships with new distributors are established via international tenders, which

in some cases are solely based on commissions to be paid to distributors rather than

on the quality of the products to be distributed. As highlighted by 19 insurers, this

can result in very high commission rates reaching in some cases well above 50%

of the premium, yet these higher commissions are not correlating with improved

services for the customer from the distributor;

› Around 70% of insurers exclude pre-existing medical conditions from the coverage

of travel insurance products and most of these insurers do not use pre-contractual

medical screening. Such screening is more common at the claim stage in order to

identify if the incident is caused by a pre-existing medical condition, as a basis for

dismissing the claim;

› Overlaps in cover are not assessed in the sale process in most cases. The assess-

ment is done at the claim stage in order to identify which policy will cover the inci-

dent and the expenses will be split between insurers. This can be anticipated to

increase costs for consumers.

Given these findings, EIOPA will now work on a number of measures to improve the

quality of outcomes for consumers in this market. EIOPA considers that improvements

are necessary, and will examine all the tools available for driving these improvements.

Tools available include:

› a warning to the industry on high commissions and business models that rely on

such remuneration structures. Such practices are not acceptable and the conduct

risks are dicult to justify;

› a dialogue with the industry including new market players (e.g. involved in distribu-

tion), NCAs and consumer representatives on how to best tackle consumer behav-

iour in the context of such markets from a practical standpoint, including the setting

out of expectations on how to achieve value for customers buying through ancillary

distributors and in the context of ‘add-ons’;

› a setting out of expectations on the practical implementation of IDD - as a rein-

forcement of the importance of rules on acting in the best interests of the customer,

on conflicts of interest and on product oversight and governance;

› working with national supervisors to identify priority parts of the business where

enhanced supervisory attention would be justified; and

› a dialogue on the use of commission caps as a stronger intervention as necessary.

CONSUMER PROTECTION ISSUES IN TRAVEL INSURANCE: A THEMATIC REVIEW

7

INTRODUCTION

Alongside other add-on and ancillary insurance products,

travel insurance has been under the spotlight for a num-

ber of years. In 2017, 11 National Competent Authorities

(NCAs) reported an increase in cross-selling of ancillary

insurance products in general, and specific issues in rela-

tion to travel insurance have been reported for several

years via EIOPA’s Consumer Trends work.

For example, although the total number of travel insur-

ance related complaints are a small part of all complaints,

the Consumer Trends work showed that in 2017, travel

insurance related complaints increased 85% (from 23.499

to 43.363 complaints), having increased in 14 of the 20

Member States which reported information on travel

insurance (in 3 Member States more than 120%).

In light of these concerns and the potential for consumer

detriment NCAs have increased their focus on add-on/

ancillary insurance in general and on travel insurance in

particular.(

1

) Amongst the 64 thematic activities reported

by NCAs to EIOPA in 2017, 11 looked at travel insurance

amongst other issues and in 2018, out of the 63 activities,

12covered travel insurance.

(

1

) For example, the Financial Conduct Authority (FCA) recently pub-

lished a report on a thematic review on ‘General Insurance’ that included

travel insurance. The Australian Securities and Investment Commission

(ASIC) has focused on ‘add-on insurance through car dealers’. The Isti-

tuto per la Vigilanza Sulle Assicurazioni (IVASS) conduct several thematic

reviews covering add-on and ancillary insurance.

Turning to Solvency II data, this is only available by line of

business, preventing clear conclusions on conduct risks

in the travel insurance market being drawn. While travel

insurance data mainly falls under the Assistance line

of business it can also be reported under other lines of

business (e.g., Medical Expense, Miscellaneous Financial

Loss); in addition, these lines of business also cover other

products (e.g., road-assistance). Moreover, conduct rele-

vant data, in particular qualitative data, is limited.

Despite this, an analysis of certain retail risk indicators

based on available Solvency II data can show where

potential issues and causes for consumer detriment might

arise in relation to travel insurance.

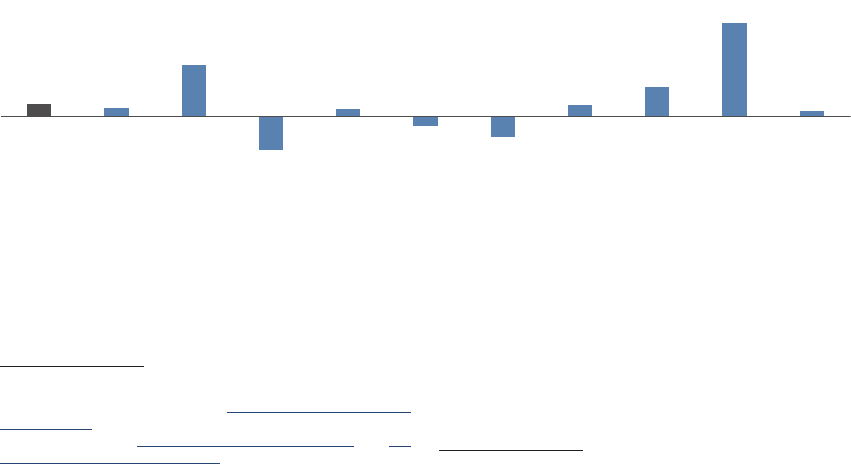

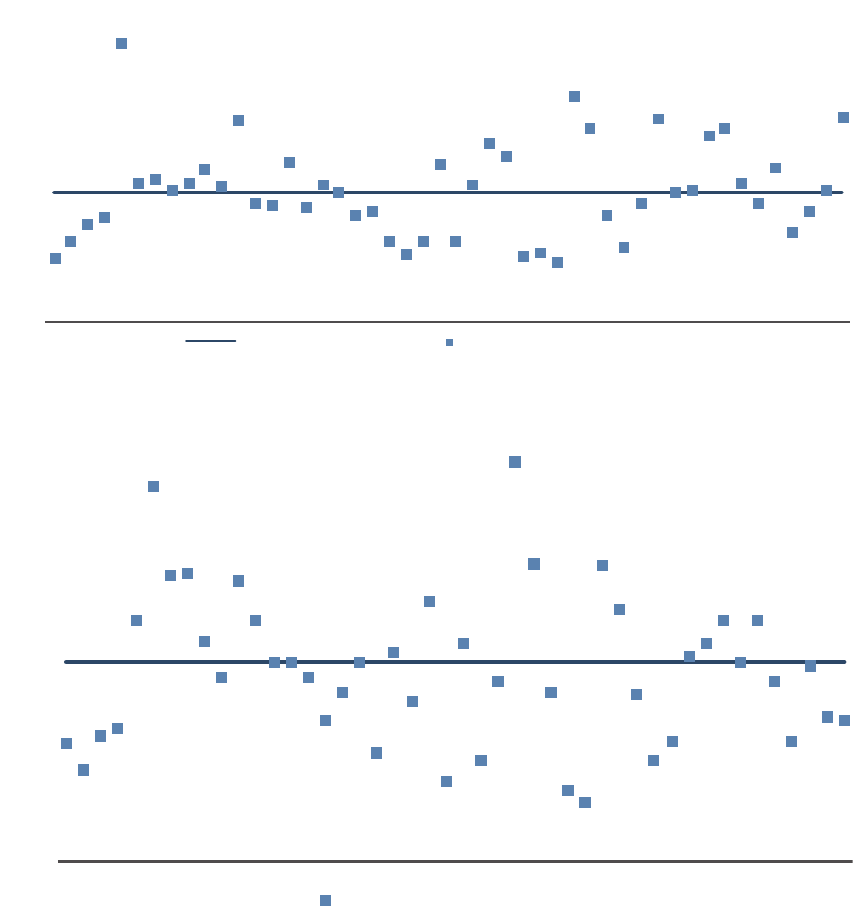

By looking at the assistance line of business, it can be

noticed that the 1% - average GWP growth in 2017 for the

assistance line of business in the EEA(

2

) has been in line

with the non-life insurance as a whole. (Figure 1)

(

2

) Data available for 28 EEA countries out of 31

Source: EIOPA Solvency II Database

Figure 1 - GWP growth in the EEA for 2017 vs 2016

1%

1%

5%

-3%

1%

-1%

-2%

1%

3%

10%

1%

Assistance Medical

Expense

Income

protection

insurance

Workers'

compensation

insurance

Motor vehicle

liability

insurance

Other

motor

insurance

Fire and other

damage to

property

insurance

General

liability

insurance

Legal

expenses

insurance

Miscellaneous

financial loss

Total

EUROPEAN INSURANCE AND OCCUPATIONAL PENSIONS AUTHORITY

8

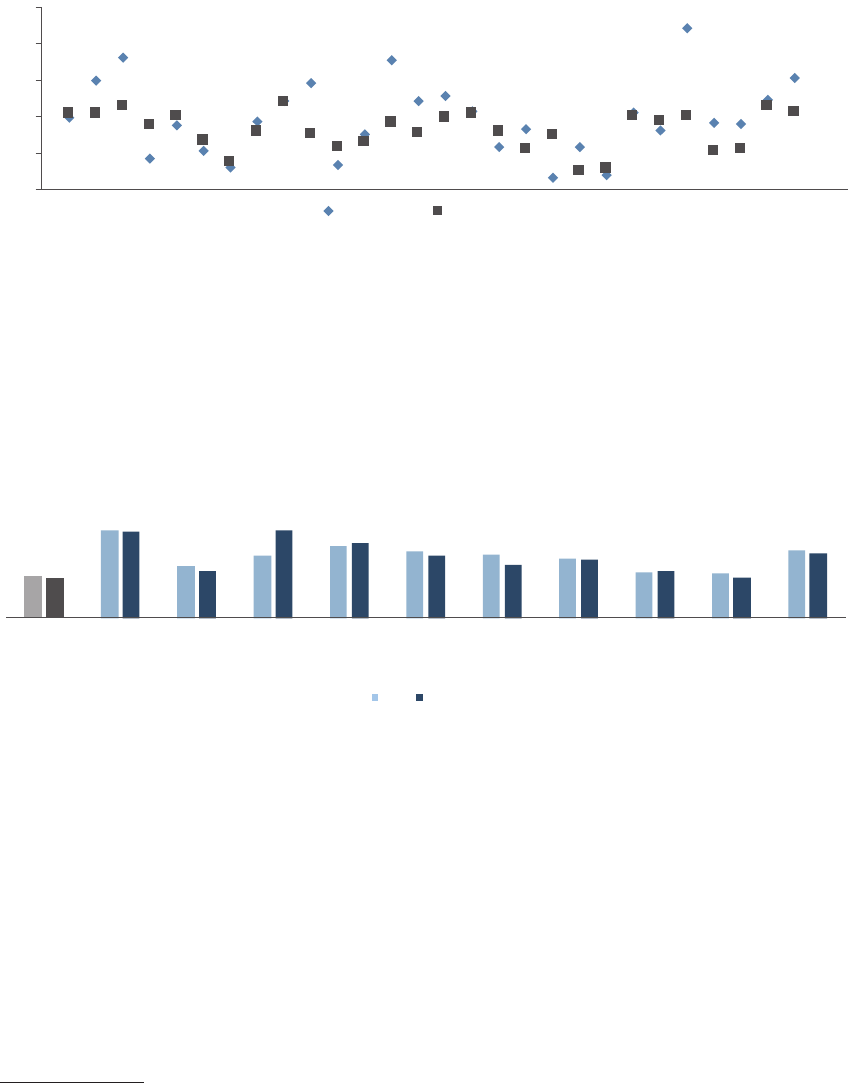

The EEA(

3

) average commissions in the assistance busi-

ness line in 2017 were 19% compared to 14% for non-life

insurance as a whole.

(

3

) Data available for 28 countries of the EEA out of 31.

However, in 16 countries of the European Economic Area

(EEA), the average GWP growth has been higher in the

assistance business line than for non-life insurance as a

whole. Moreover, in 19 countries, the GWP growth rate

has been higher than the average EEA GWP growth rate

of 1%. In 7 EEA countries, the GWP experienced a signifi-

cant growth of more than 20%.

Source: EIOPA Solvency II Database

Figure 2 - EEA GWP growth for assistance vs non-life in 2017

–40.0%

–20.0%

0.0%

20.0%

40.0%

60.0%

80.0%

Assistance Total NL

Source: EIOPA Solvency II Database

Figure 3 - Average commissions in the EEA in the non-life insurance

19%

16%

20%

18%

17%

17%

18%

6%

29%

12%

14%

18%

16%

19%

18%

18%

18%

20%

6%

29%

12%

14%

Assistance

Medical

Expense

Income

protection

insurance

Workers'

compensation

insurance

Motor

vehicle

liability

insurance

Other motor

insurance

Fire and

other

damage to

property

insurance

General

liability

insurance

Legal

expenses

insurance

Miscellaneous

financial loss

Total

2017 2016

CONSUMER PROTECTION ISSUES IN TRAVEL INSURANCE: A THEMATIC REVIEW

9

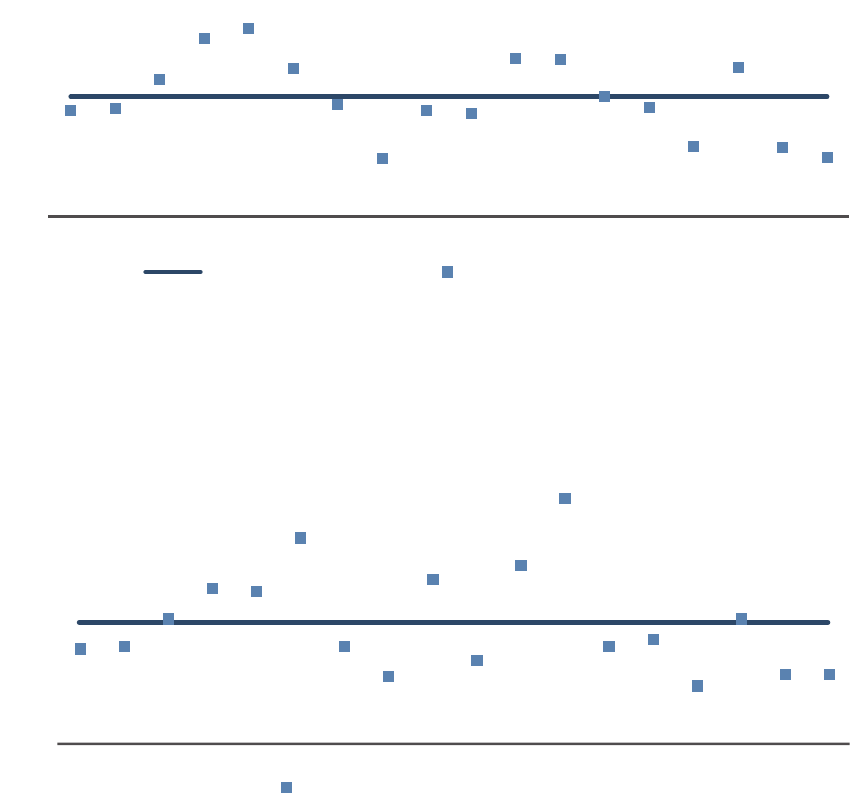

The average claims ratio for assistance in 2017 in the

EEA (

4

) countries has been 40%, compared to 63% for

the non-life insurance as a whole, being the lowest claims

ratio amongst non-life insurance lines of business.

(

4

) Data available for 28 EEA countries out of 31.

Source: EIOPA Solvency II Database

Figure 4 - Commission levels in assistance vs non-life

0%

10%

20%

30%

40%

50%

Assistance Total Non Life

At the Member State level, it can be noticed that in 26

countries, the average claims ratio in 2017 for assistance

was lower than for non-life insurance as a whole. Further-

more, in 17 countries, the claims ratio for the assistance

line of business was lower than the EEA average and in 8

countries the claims ratio was lower than 30%.

Source: EIOPA Solvency II data

Figure 5 - Average claims ratio in non-life insurance in 2017 vs 2016

40%

85%

50%

60%

69% 64%

61%

57%

44%

43%

65%

39%

84%

45%

85%

73%

60%

51%

56%

46%

39%

63%

Assistance Medical

Expense

Income

protection

insurance

Workers'

compensation

insurance

Motor vehicle

liability

insurance

Other

motor

insurance

Fire and other

damage to

property

insurance

General

liability

insurance

Legal

expenses

insurance

Miscellaneous

financial loss

Total

2017 2016

In 16 countries, the average commission rates in the assis-

tance business line were higher than the average commis-

sions in non-life insurance as a whole (Figure 4).

EUROPEAN INSURANCE AND OCCUPATIONAL PENSIONS AUTHORITY

10

Source: Solvency II data

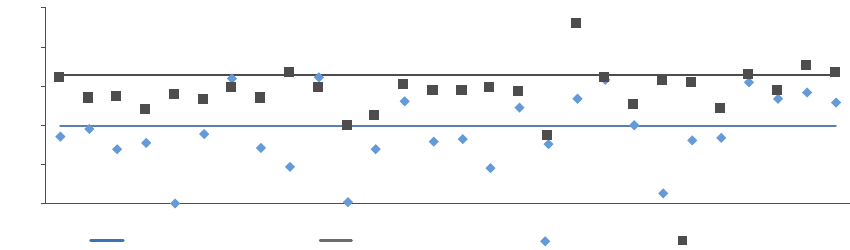

Figure 6 - Average claims ratio in non-life insurance in 2017

0%

20%

40%

60%

80%

100%

EEA Assistance average EEA Total NLaverage Assistance Total Non Life

Considering the reported potential for consumer detri-

ment as well as the emergence of a trend, in 2018 EIOPA

launched a thematic review on travel insurance, with the

aim of better understanding possible drivers and their

materiality for consumer detriment.

CONSUMER PROTECTION ISSUES IN TRAVEL INSURANCE: A THEMATIC REVIEW

11

METHODOLOGY

As explained in the published industry questionnaire, for

the purpose of this thematic review EIOPA followed an

agreed upon methodology. EIOPA gathered information

from insurance undertakings and a selection of stake-

holders:

1. Insurance undertakings: Evidence from insurance

undertakings was collected via an Industry Ques-

tionnaire (IQ) sent to a sample of 201 insurance

undertakings operating in 29 Member States. (

5

) The

questionnaire has been distributed by the NCAs to the

selected insurance undertakings only – no information

has been collected directly from intermediaries.

The decision on the sample composition has been

taken by each NCA considering local market specifi-

cities, to ensure market representativeness. In select-

ing which insurance undertakings to include in the

sample, NCAs considered the following principles:

¡ Include insurance undertakings of dierent

sizes;

¡ Include 7 of the largest 10 insurance

undertakings;

¡ Represent 60% of gross written premiums.

(

5

) EEA Member States excluding CY and LI.

The questionnaire covered quantitative (

6

) and quali-

tative information on:

¡ The main characteristics of travel insurance

products;

¡ Sales practices and consumer behaviour, and

¡ Emergence of new distributional channels and

new business models.

The collected information from participating insur-

ance undertakings provided a market-oriented and

practical perspective on the degree and extent to

which new innovative distribution channels and busi-

ness models are aecting, or are expected to aect

the travel insurance market.

2. Stakeholders: Evidence from stakeholders mainly

included discussions with the industry and consum-

ers’ associations as well as EIOPA’s Insurance and

Reinsurance Stakeholders’ Group (IRSG). Informa-

tion requested from stakeholders mainly concerned

emerging distribution channels and business models

and how these can aect consumers.

(

6

) The reference reporting date was 31.12.2017

EUROPEAN INSURANCE AND OCCUPATIONAL PENSIONS AUTHORITY

12

1. OVERVIEW OF TRAVEL

INSURANCEMARKET

1.1. GENERAL OVERVIEW

According to the United Nations World Tourism Organ-

isation (UNWTO), international tourism has been expe-

riencing accelerating growth (

7

) since 2010. In 2017 in

Europe, international arrivals grew 8.4% against a global

average of 7%. (

8

) European travel demand increased and

Europeans have retained the status of the most travelled

nations in the world, accounting for 48% of the outbound

tourism in 2017. According to Eurostat, in 2017 the EU resi-

dents made around 1.3 billion trips. Moreover, around 62%

of EU residents made at least one personal trip in 2017. (

9

)

In this regard and considering that very often travel insur-

ance is bought jointly with trips, from a consumer’s per-

spective, the cost of travel insurance represents only a

fraction of the total cost of the primary travel product. (

10

)

Despite this apparent reduced relevance for industry and

consumers, from a forward-looking consumer protec-

tion perspective, travel insurance is expected to grow

in importance, and the aggregate impact of poor value

for money can be notable. In addition, from an individual

perspective, detriment could be significant e.g. where the

financial impact of medical expenses while traveling can

be large (see Section 3.4).

The demand for travel insurance is expected to follow

the growth in the tourism industry fuelled by a recover-

ing economy and higher demand from a growing number

of wealthier senior citizens and to benefit from greater

awareness of this type of product by consumers. (

11

)

(

7

) This is calculated based on arrivals.

(

8

) UNWTO Tourism Highlights: 2018 Edition https://www.e-unwto.

org/doi/book/10.18111/9789284419876

(

9

) Tourism statistics for 2017, Eurostat https://ec.europa.eu/eurostat/

statistics-explained/Tourism_statistics

(

10

) A general rule of thumb is that a package plan will cost between 5%

and 7% of the total trip cost depending on the plan.

(

11

) Global travel insurance market – Allied Market Research; available

at: https://www.alliedmarketresearch.com/travel-insurance-market.

Furthermore, the competitive and distribution dynamics

of the market are expected to continue to evolve. The

shift in the market from being primarily local and in-

person to global and remote (i.e., online access) is leading

to the emergence and consolidation of new distribution

channels, new ways of engaging with customers, and a

new breed of competitors and disruptors of the tradi-

tional business models (see Section 2.3). These changes

are relevant for consumers and the insurance industry as

a whole given that these changes may well find parallels

in other insurance products.

From an industry perspective, travel insurance is one

of the smallest non-life lines of business. Based on the

data reported by the insurance undertakings in the IQ on

GWP, travel insurance accounts for 4% of the total non-

life insurance business. The year-on-year growth in travel

insurance was around 3% in 2016 compared to 2015. In

2017, travel insurance experienced a significant growth

of 9%, while non-life insurance in general experienced a

growth of 5% both in 2016 and in 2017.

Alongside growth in travel, travel insurance has also

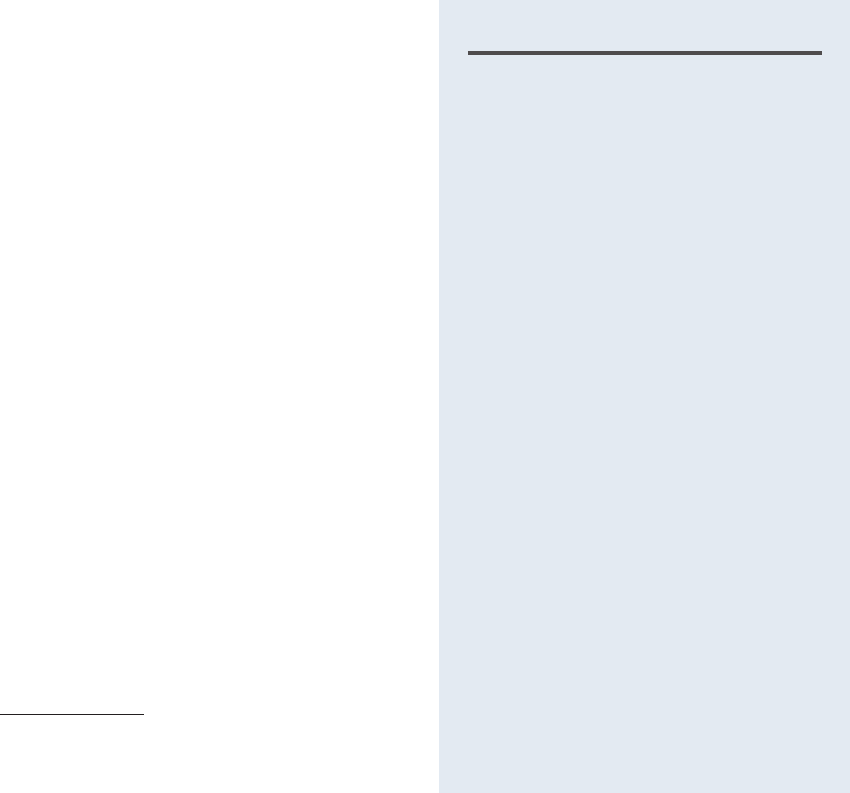

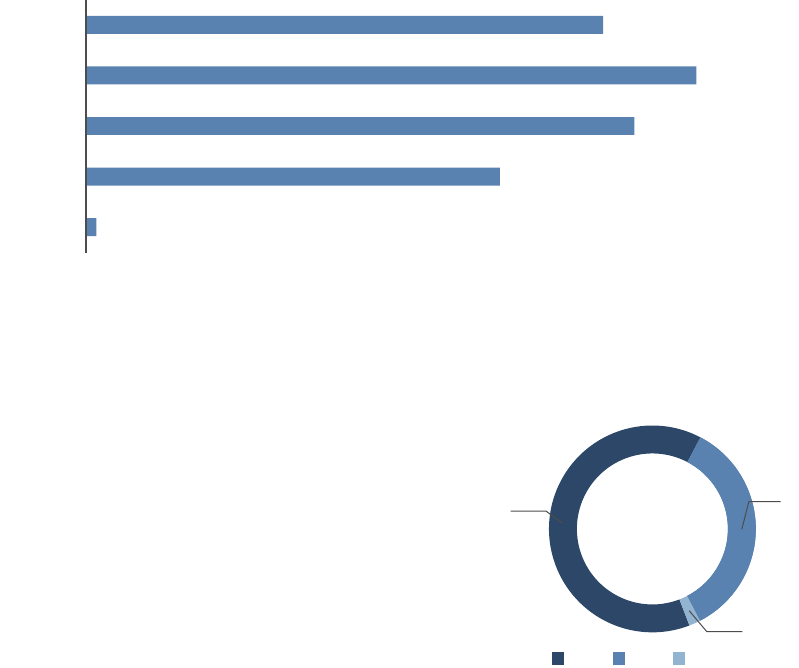

increased; in fact, as shown in Figure 7 the travel insur-

ance market experienced a significant growth in terms of

number of policies. In 2016 the number of new policies

underwritten by the participants in the questionnaire was

73 million (+3.7% compared to 2015) and 2017 it reached

83 million (+13.2% compared to 2016).

Figure 7 - Number of new policies

70

73

83

3.7%

13.3%

–10%

–5%

0%

5%

10%

15%

64

66

68

70

72

74

76

78

80

82

84

2015 2016 2017

Millions

Number of Policies YoY Growh

Source: EIOPA Travel Insurance thematic review

CONSUMER PROTECTION ISSUES IN TRAVEL INSURANCE: A THEMATIC REVIEW

13

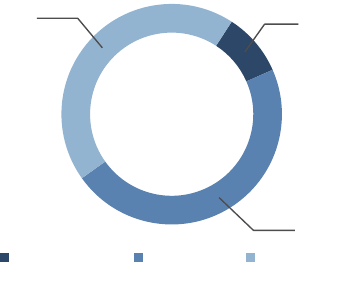

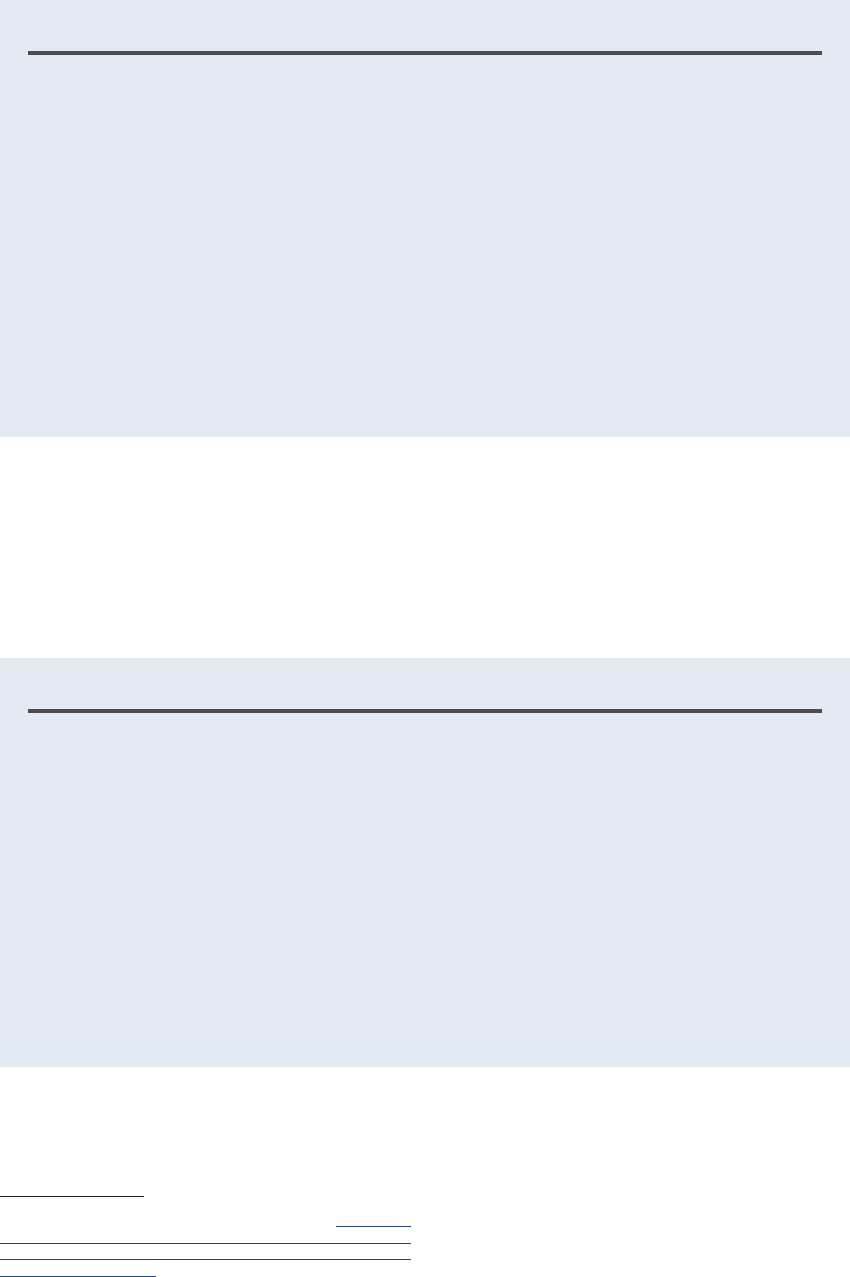

In fact, while often being low cost products, (

12

) travel

insurance coverage can bring significant benefits to con-

sumers; indeed this is a fundamentally retail business -

the vast majority of customers are retail (92% of the total

travel insurance GWP concerns policies sold to retail cus-

tomers, while corporate customers account only for 8%).

(

12

) This can be seen from a comparison of GWP with numbers of poli-

cies reported for 2017 – leading to an average policy of around 30 EUR.

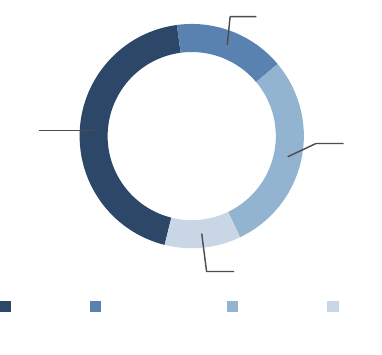

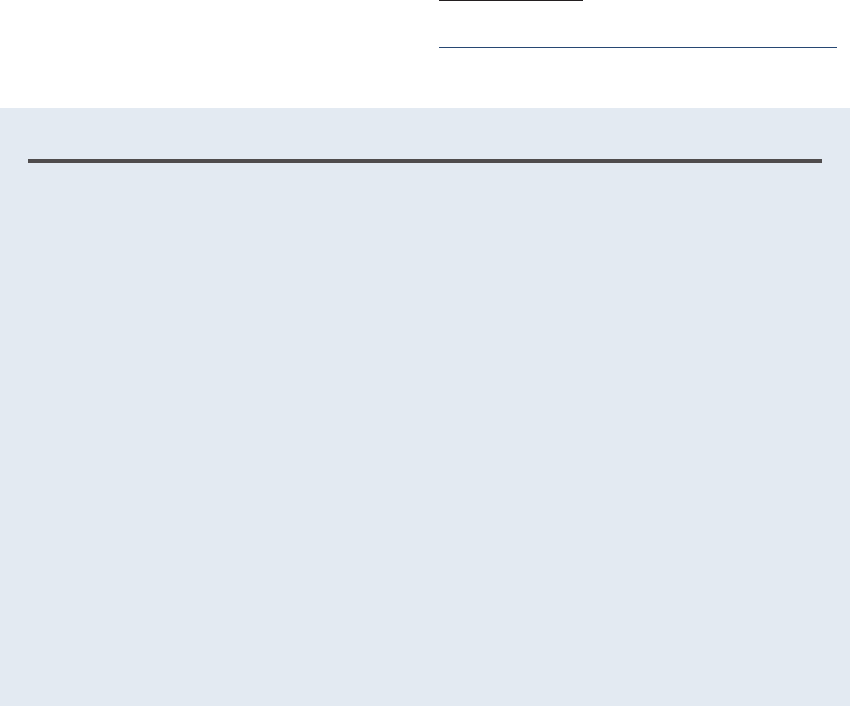

Figure 8 - Travel insurance customers

92%

8%

Retail customers Corporate customers

Source: EIOPA Travel Insurance thematic review

EUROPEAN INSURANCE AND OCCUPATIONAL PENSIONS AUTHORITY

14

1.2. TRAVEL INSURANCE

PRODUCTS (

13

)

As mentioned, travel insurance products are generally low

cost products covering a wide variety of risks. One of the

key characteristics is that travel insurance is often sold as

ancillary to other products and/or it is often included in

a package, leading to important behavioural biases in the

sale process. (

14

) (see Section 4.1.1)

This also implies that, while for other types of insurance

products specific distribution channels are prevalent (e.g.,

in many markets agents and comparison websites are

the most common distribution channels for Motor Third

Party Liability – MTLP – policies (

15

)) travel insurance is

placed on the market via a wide variety of distribution

channels. These include direct writers, insurance brokers

and agents, mainstream travel agents, tour operators,

airlines, ferries/railway operators, banks, credit card pro-

viders, online travel specialists and comparison websites/

aggregators.

Travel insurance is generally available in two forms: (i) as

a single-trip insurance policy, which provides cover for a

specific trip and is matched to the exact characteristic of

the trip (e.g. number of travelling days and destination)

and (ii) as an annual insurance policy, which covers mul-

tiple trips in a year.

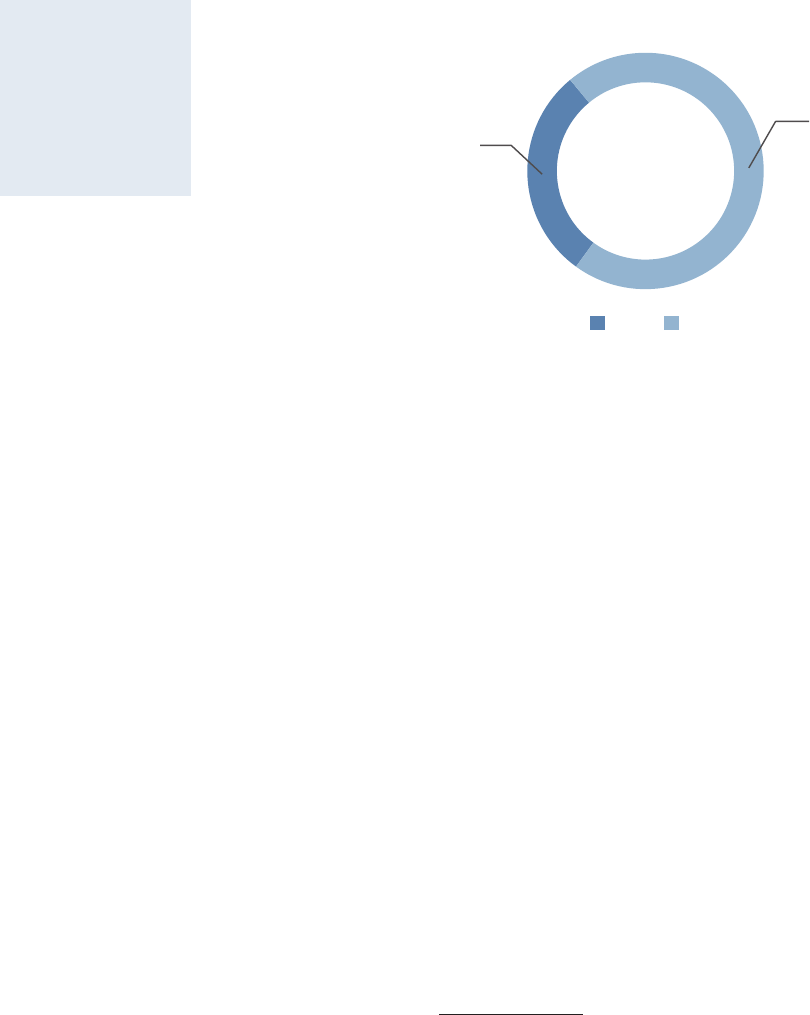

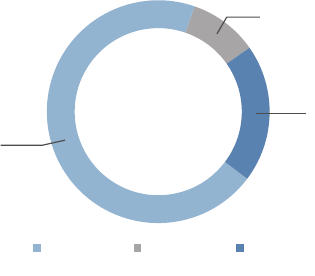

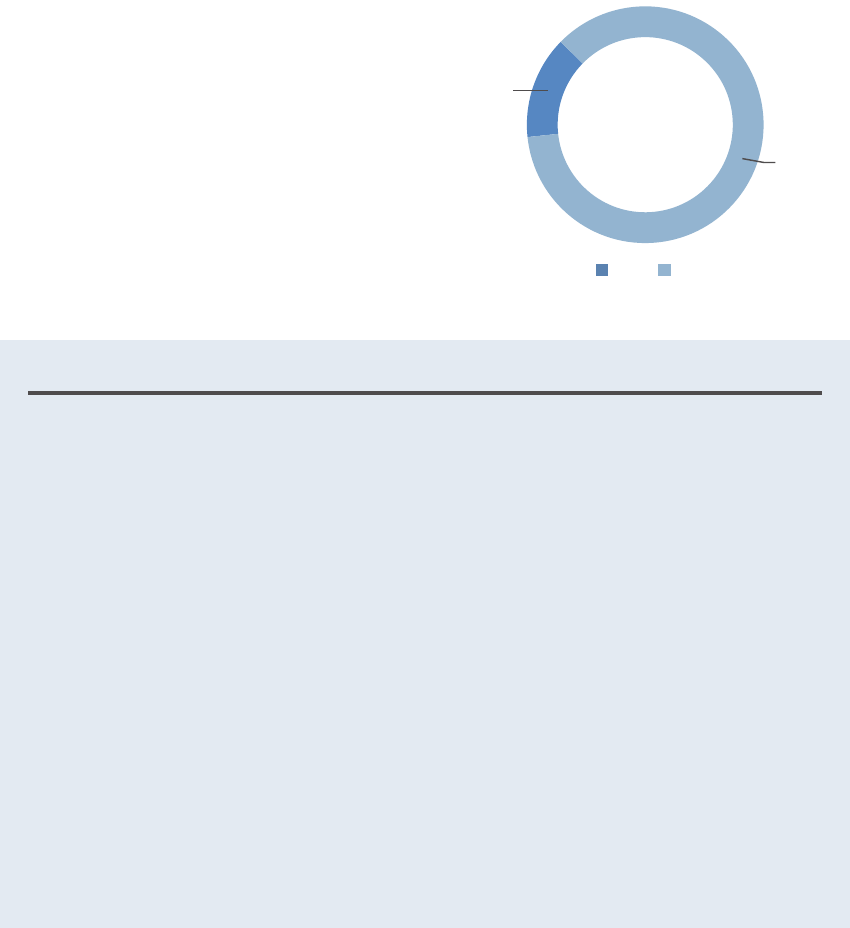

The split appears to be equal; in fact, in 2017 travel

insurance GWP collected by the participants in the IQ

accounted for 2.9 billion euros split as follows (Figure 9):

58% of the GWP have been collected through Multi-trip

policies and 42% through Single-trip policies.

Single-trip policies are mainly sold via ancillary insurance

intermediaries (52% of total single trip GWP) and by

insurance agents/ brokers (24% of total single-trip GWP),

followed by direct sales (17%). Single-trip policies sold via

bancassurance represented only 2% and comparison web-

sites/ aggregators only 3%.

(

13

) All types of travel insurance were within the scope of the thematic

review with the exception of products covering long uninterrupted stays

abroad, given their unique purpose and characteristics, in particular in

which concerns the specific cover they oer (in most cases limited to

explicit medical costs).

(

14

) A general rule of thumb is that a package plan will cost between 5%

and 7% of the total trip cost depending on the plan so consumers do not

pay much attention to the travel insurance product.

(

15

) Evaluation of the Structure of Insurance Intermediaries Markets in

Europe in accordance with Article 41(5) of the Insurance Distribution

Directive (IDD), EIOPA https://eiopa.europa.eu/the-European-Insur-

ance-Intermediaries-Markets.aspx

With regard to Multi-trip policies the situation is reversed.

Multi-trip policies are mainly sold via bancassurance (46%

of the multi trip GWP) followed by insurance agents/ bro-

kers (22%) and direct sales (20%). In this case, ancillary

insurance intermediaries collected only 9% of the total

GWP for multi-trip policies.

Within these two broad groups, several types of cover

are available to consumers, e.g. trip cancelation & inter-

ruption, emergency medical costs, rental car insurance

excesses, etc. Travel insurance may also be available as

individual policies or group policies intended to cover

multiple individuals (e.g. families, groups or employees of

the same entity). In addition to single-trip or annual travel

insurance, some products sold under the label of travel

insurance are designed to provide cover for long uninter-

rupted stays abroad, for instance for students studying

abroad. These tend to cover medical costs only.

Figure 9 - Collected GWP for Single-trip and Multi-trip

policies

42%

58%

Single-trip Multi-trip

Source: EIOPA Travel Insurance thematic review

CONSUMER PROTECTION ISSUES IN TRAVEL INSURANCE: A THEMATIC REVIEW

15

1.3. FINANCIAL RATIOS IN

TRAVEL INSURANCE

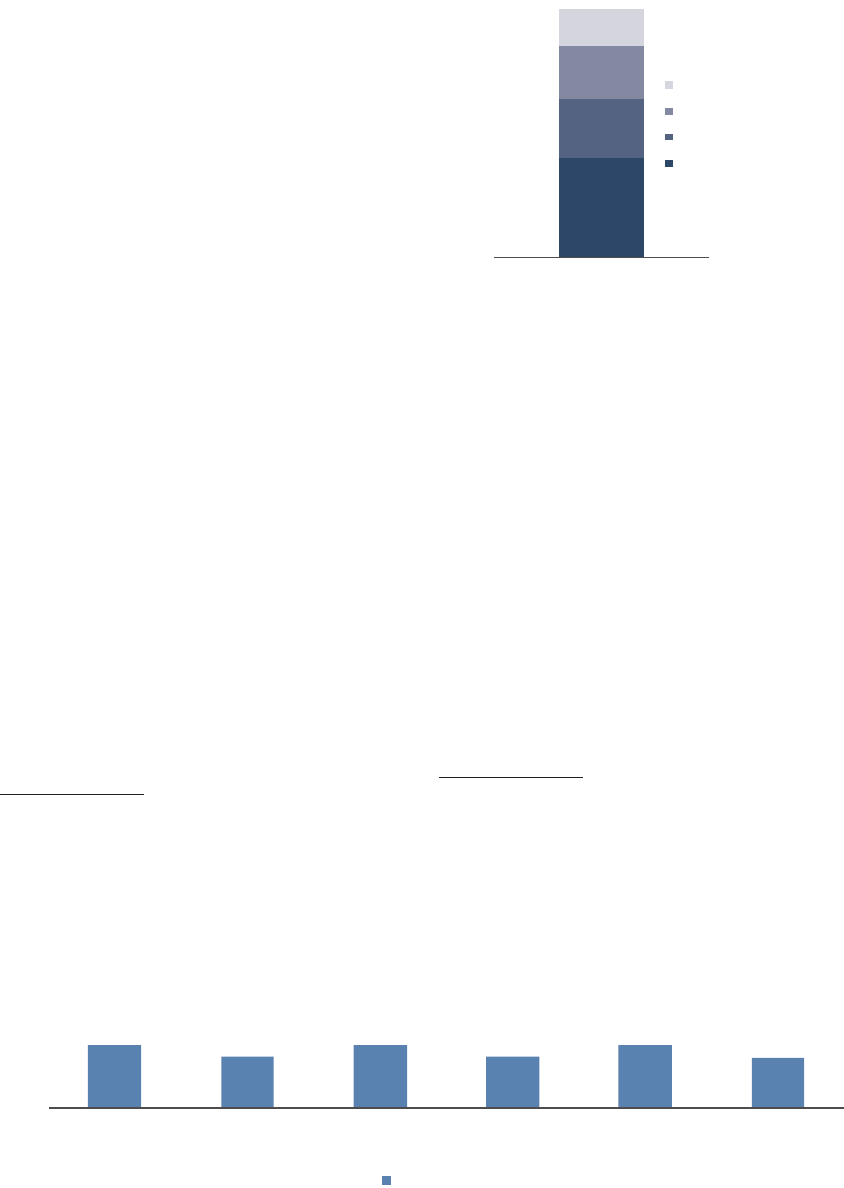

From an analysis of selected financial ratios, travel insur-

ance seems to be a more profitable business for insurers

compared to non-life insurance business as a whole.

¡ Insurers make more profit by underwriting

travel insurance: the net underwriting result in

travel insurance (15%) is higher than for non-life

insurance business as a whole (10%).

¡ The average claims ratio, as reported by the

insurance undertakings is lower in travel insur-

ance (40%) compared to the non-life insurance

as a whole (53%).

¡ Moreover, average commission levels in travel

insurance are higher (24%) compared to the

entire non-life insurance business (18%). These

averages mask significant divergences however:

extreme commissions are highly concerning

from a supervisory standpoint. (see Section 1.4)

¡ Average levels of expenses, as reported by the

insurers are in line with non-life business as a

whole, around 19%.

Insurers reported a trend of growing collected premiums

over the last three years preceding 2017. Indeed, based

on the data reported by the insurance undertakings in

the IQ, the total collected GWP experienced a growth of

3% in 2016 compared to 2015 and a growth of 7% in 2017

compared to 2016.

Figure 11 presents the GWP split per distribution channel.

Ancillary insurance intermediaries collected 27% of the

total GWP, bancassurance 26% and insurance agents/

brokers collected 23%. Insurers collected 18% of the total

GWP through direct sales. Price comparison websites and

aggregators are still at an emergent stage and the total

collected GWP accounts only for 2%. However, in the

case of those insurers that use price comparison websites

and aggregators, collected premiums via this channel go

up to 15%-25% of the total collected GWP.

The above average claims ratio and average commission

levels in travel insurance are not representative for the

whole sample of participants in the IQ. There are cases

where the two indicators for some insurance undertak-

ings are extremely divergent from the average.

A more detailed analysis on commission levels and claims

ratios is presented in the next Sections 1.4 and 1.5.

Source: EIOPA Travel Insurance thematic review

Figure 10 –Average financial ratios in travel insurance vs non-life insurance as a whole

40%

24%

20%

15%

53%

17%

19%

10%

0%

10%

2

0%

30%

4

0%

50%

60%

Claims ratio Commission rates Expenses Net underwritting result

Travel Insurance Non-Life

Source: EIOPA Travel Insurance thematic review

Figure 11 - GWP split by distribution channel

18%

26%

23%

2%

27%

3%

Direct sales

Bancassurance

Insurance agent / broker

Comparison website / aggregator

Ancillary insurance intermediary (total)

Other distribution channel

EUROPEAN INSURANCE AND OCCUPATIONAL PENSIONS AUTHORITY

16

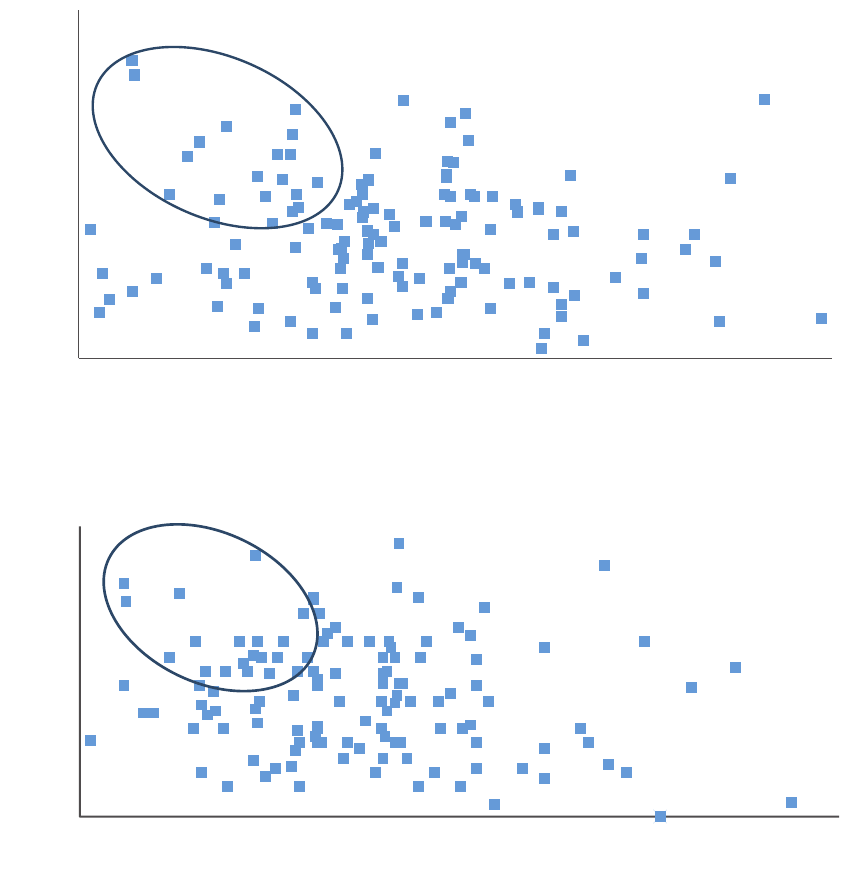

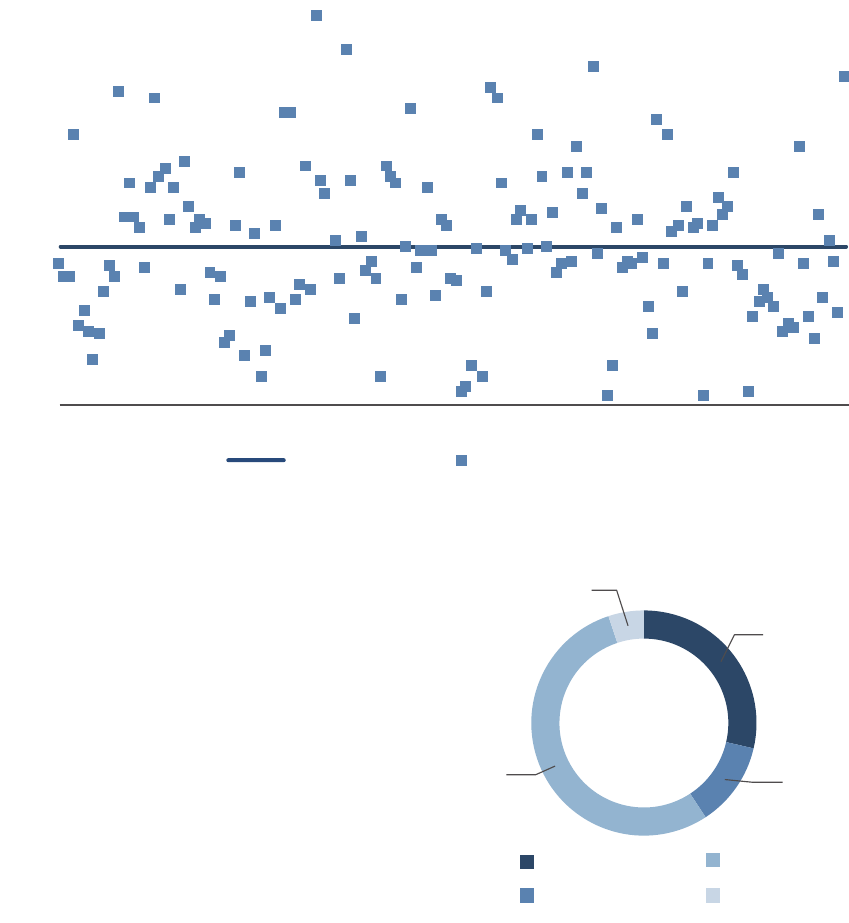

The Figure 12 presents the average commission levels and

claims ratios for each insurance undertaking. It is notice-

able that 38 insurance undertakings paying commissions

above the average of 24% of the GWP have claims ratios

below the average of 40% of the GWP. As shown in the

bubble in Figure 12, 18 insurance undertakings have aver-

age commission levels above 30% of the GWP and claims

ratios inferior to 30% of the GWP.

Additionally, when analysing the maximum commissions

paid to distributors together with the claims ratios for each

insurance undertaking, the connection between high com-

missions and low claims ratios is accentuated. (Figure 13)

24 insurance undertakings pay commissions above 50%

of the GWP and have claims ratios below 35% of the GWP.

The number increases if the threshold for the claims ratio

is increased to 50% of the GWP. (Figure 13)

Out of the 24 insurance undertakings, 14 sell mainly sin-

gle-trip policies (more than 50% of the total collected

GWP) and 4 sell mainly multi-trip insurance policies. 6

out of 14 insurance undertakings use ancillary insurance

intermediaries as the main distribution channel to sell

their single-trip policies.

Source: EIOPA Travel Insurance thematic review

Figure 12 - Average commissions and claims ratios

0%

10%

20%

30%

40%

50%

60%

70%

0% 10% 20% 30% 40% 50% 60% 70% 80% 90%

Commission Rates

Claims Ratios

Source: EIOPA Travel Insurance thematic review

Figure 13 - Maximum commission levels and claims ratios

0%

20%

40%

60%

80%

100%

0% 20% 40% 60% 80% 100%

Maximum commissions

Claims ratios

CONSUMER PROTECTION ISSUES IN TRAVEL INSURANCE: A THEMATIC REVIEW

17

1.4. COMMISSION LEVELS IN

TRAVEL INSURANCE

Although the premiums for travel insurance products are

relatively small compared to other insurance products,

high commissions paid by insurers to distributors may

lead to increased prices for consumers. High levels of

remuneration of firms that incur little costs and do not

deliver services corresponding to the received commis-

sions might raise significant potential for harm and poor

outcomes for consumers. High commissions paid to dis-

tributors can indicate excessive pricing for products of

which the costs are very low.

As reported by insurers in the IQ, commission levels vary

by type of distribution channels and the main determi-

nants of the commission levels paid to distributors are:

¡ Volume of policies sold;

¡ Profitability and performance of the distribution

channel;

¡ Claims ratio;

¡ Market power and size of the customer base;

¡ Exclusivity clauses;

¡ Activities performed (i.e. marketing);

Around 80% of insurance undertakings said they consid-

ered that the actual commission levels paid to distribu-

tors are justified based on the activities performed by the

distributors (i.e., marketing, on-boarding of customers,

claims management, etc.). However, this is not the case

for all distribution channels, and it is not clear that this

conclusion would apply also to higher than average com-

missions. Some respondents consider that in the case of

online insurance aggregators, travel agencies and tour

operators, the commission levels are very high and not

justified, as the eorts made to sell the policies are low in

comparison with other distributors.

It can be argued that commissions charged by these dis-

tributors may relate more to their market power than to

the actual customer acquisition and policy-servicing work

they perform. According to some insurers, commission

levels above 30%-40% of the premium are not justified.

Although the average commission levels reported in the

question on financial ratios in the IQ (Figure 10) indicate

that on average insurers pay 24% of GWP in commissions

to distributors, a more in-depth data analysis paints a

dierent picture. There is significant dispersal in commis-

sion levels, which raises significant consumer protection

concerns.

... BANCASSURANCE

The average commission paid by insurers to banks is

around 26% of the GWP. However, half of the respond-

ents pay commissions higher than the average, going up

to 40% of the GWP. (Figure 14)

Out of those respondents that use bancassurance as

a distribution channel, 47% reported paying maximum

commission levels of 40% of GWP and more. (Figure 15)

In some cases, the commissions paid to banks are high,

reaching 56% of the GWP.

Source: EIOPA Travel Insurance thematic review

Figure 14 - Average commissions in Bancassurance

0%

10%

20%

30%

40%

50%

General average Average commissions

EUROPEAN INSURANCE AND OCCUPATIONAL PENSIONS AUTHORITY

18

... INSURANCE AGENTSBROKERS

Based on the data reported by the respondents, the

average commission levels paid by insurers to insurance

agents/brokers is around 27% of the GWP. However, 40%

of insurers pay commissions higher than the average,

going up to 50% of the GWP in some cases.

Although insurance agents/brokers execute the main func-

tions for concluding a contract with consumers, such higher

levels of commission may not be considered appropriate.

Around 23% of respondents reported maximum commis-

sions over 50% of the GWP and 4% reported commissions

above 78% of the GWP, which is extremely high. (Figure 17)

Source: EIOPA Travel Insurance thematic review

Figure 15 - Maximum commissions in Bancassurance

0%

10%

2

0%

30%

4

0%

50%

60%

Max commission levels

Source: EIOPA Travel Insurance thematic review

Figure 16 - Average commissions to Insurance agents/ brokers

0%

10%

2

0%

30%

4

0%

50%

60%

General average Average commissions

Source: EIOPA Travel Insurance thematic review

Figure 17 - Maximum commissions to insurance agents/ brokers

0%

20%

40%

60%

80%

100%

Maximum commissions

CONSUMER PROTECTION ISSUES IN TRAVEL INSURANCE: A THEMATIC REVIEW

19

... ANCILLARY INSURANCE

INTERMEDIARIES

The average commissions paid to ancillary insurance

intermediaries by the insurance undertakings are around

33% of the GWP. (Figure 18)

Over 40% of respondents reported maximum commis-

sions of more than 50% of the GWP, and 14% reported

paying maximum commissions of more than 70% of the

GWP. (Figure 19) In one case, the insurer reported paying

maximum commissions of 94% of the GWP.

An analysis of the data on maximum commissions and

proportion of denied claims in total claims showed that 16

insurance undertakings that pay maximum commissions

of more than 30% of the GWP have proportions of denied

claims above the average of 17% of total number of claims.

Out of the 16 insurance undertakings, 9 pay maximum

commissions of more than 50% of the GWP and have pro-

portions of denied claims going from 20% to 69% of the

total claims. (see more in Section 1.5 on denied claims)

Source: EIOPA Travel Insurance thematic review

Figure 18 - Average commissions to ancillary insurance intermediaries

0%

10%

20%

30%

40%

50%

60%

70%

80%

General Average

Average commissions

Source: EIOPA Travel Insurance thematic review

Figure 19 - Maximum commissions to ancillary insurance intermediaries

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Maximum commission

EUROPEAN INSURANCE AND OCCUPATIONAL PENSIONS AUTHORITY

20

Source: EIOPA Travel Insurance thematic review

Figure 20 - Average commissions to comparison websites/aggregators

0%

20%

40%

60%

General average

Average commissions

Source: EIOPA Travel Insurance thematic review

Figure 21 - Maximum commissions to comparison websites/aggregators

0%

20%

40%

60%

80%

100%

Maximum commissions

... COMPARISON WEBSITES

AGGREGATORS

As shown earlier in Figure 11, comparison website/aggre-

gators are accounting for only 2% of the total collected

GWP by the participants in the Industry Questionnaire.

This distribution channel is still at an incumbent stage in

many of the EU Member States.

This type of distribution channel is in theory a very useful

tool for consumers that are looking to compare dierent

travel insurance products. Providing products from dif-

ferent insurance undertakings with varying prices allows

consumers to compare and choose among a variety of

travel insurance policies.

The respondents that use comparison websites/aggrega-

tors as a distribution channel reported paying on average

35% of the GWP in commissions. (Figure 20)

A third of respondents reported maximum commissions

of more than 55%, going up to 89% of the GWP. (Figure 21)

CONSUMER PROTECTION ISSUES IN TRAVEL INSURANCE: A THEMATIC REVIEW

21

1.5. CLAIMS RATIO

Claim handling is one of the key parts of an insurance

product’s lifecycle. Claims ratios are an indicator used to

measure profitability but also consumer outcomes such as

value-for-money. Low claims ratios might suggest issues

around high volumes of denied claims or consumers not

making claims because they have not been adequately

informed about the limits of the coverage of the insur-

ance contract. It could also point towards issues around

mis-selling of a travel insurance product or customers

not having the information on the claim processes. Low

claims ratios could also indicate poor value products.

Finally, this might also indicate lower incident rates than

anticipated, consumers staying healthy during their travel

and infrequent cancellations etc.

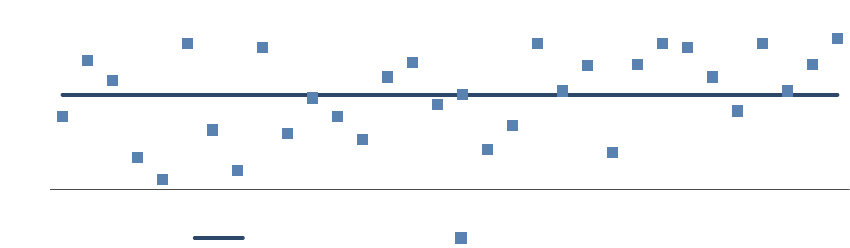

In the IQ, the respondents reported the average claims

ratio as part of the financial ratios question. Additional

reporting on claims has been done separately, insurers

indicating the:

¡ Total number of claims;

¡ Total value of claims;

¡ Total value of claims per cover;

¡ Number of denied claims;

¡ Number of denied claims per cover.

The average claims ratio (

16

) based on the data reported

by the participants to the IQ is 40% of the GWP.

(

16

) Median claim ratio calculated as a percentage of the total gross writ-

ten premiums collected by the Insurers.

A more granular analysis on claims value per distribution

channel shows that the claims ratios are not very dierent

from one channel to another. (

17

) The claims ratio for each

distribution channel has been calculated as a percentage

of GWP. The Figure 23 presents the median claims ratio for

each distribution channel.

The lowest median claims ratio is in bancassurance (29%),

comparison websites/aggregators (29%) and other distri-

bution channels (28%).

The average and median claims ratios give a general over-

view, however a more granular analysis of the individual

claims ratios for each participant in the IQ gives a dier-

ent perspective, and shows significant dispersal in results.

(

17

) It should be noted that not all respondents were able to provide the

data on claims for each distribution channel. Some of the respondents

provided only the totals of claims value

Source: EIOPA Travel Insurance thematic review

Figure 23 – Median claims ratios per distribution channel

35%

29%

35%

29%

35%

28%

0%

20%

40%

60%

80%

100%

Direct

sales

Bancassurance Insurance

agent/broker

Comparison

website/aggregator

Ancillary insurance

intermediary

Other distribution

channel

Claims Ratios

Figure 22 - Claims ratio

40%

24%

21%

15%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Net underwritting result

Average expense ratio

Average commission ratio

Average claims ratio

Source: EIOPA Travel Insurance thematic review

EUROPEAN INSURANCE AND OCCUPATIONAL PENSIONS AUTHORITY

22

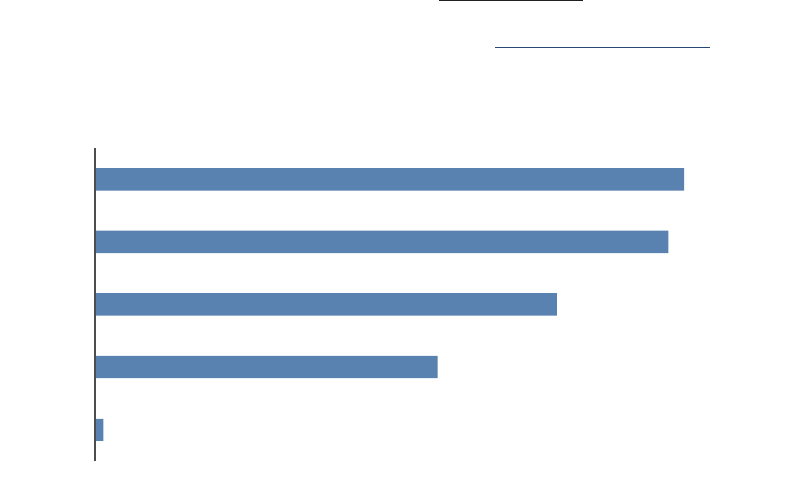

More than half of the respondents (55%) have claims

ratios below the average of 40% of the GWP. Around 15%

of respondents have claims ratios under 20% of the GWP.

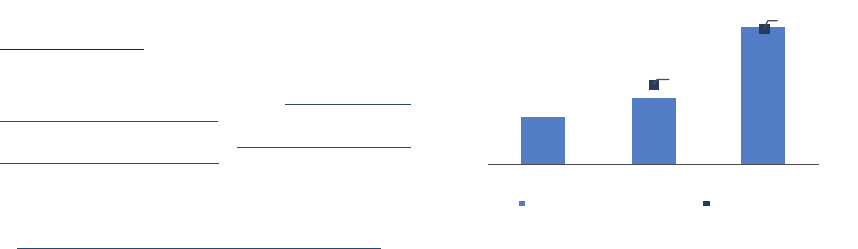

In the questionnaire, the insurance companies also

reported the number of paid claims for the following

coverages: travel journey, baggage and personal eects,

medical and other. As expected, the medical claims

account for around 54% of total paid claims. Claims paid

on baggage and personal eects are accounting for 29% of

the total number of claims, and the claims on the journey

are around 12% of the total.

When looking into the value of claims paid per cover

(in Euros), based on the data reported by the insurance

companies, the medical claims account for 58% of the

total value of claims paid to consumers.

Source: EIOPA Travel Insurance thematic review

Figure 24 - Claims ratios

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

Average claims ratio Claims ratios

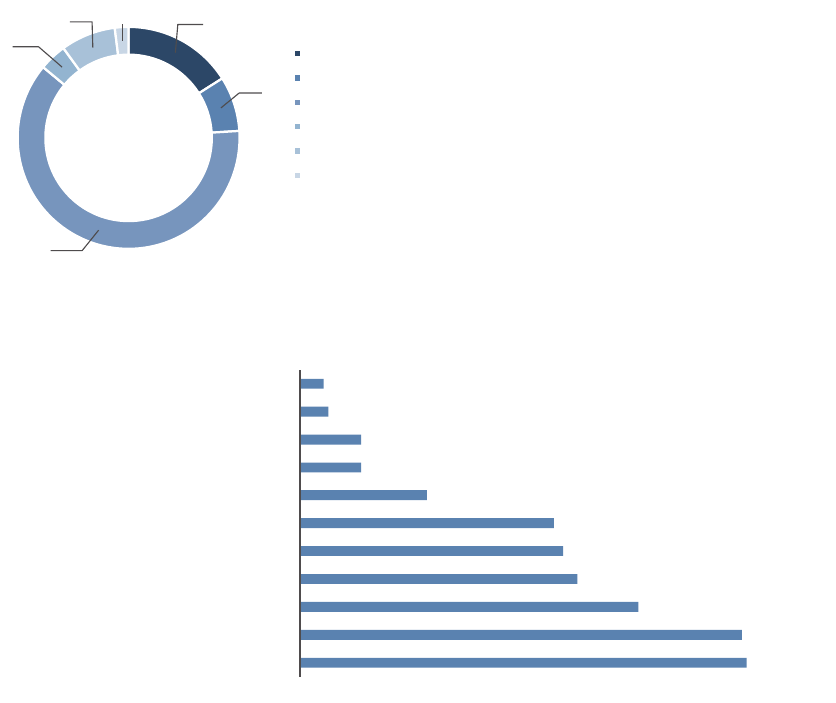

Figure 25 – Total claims paid per cover

29%

12%

54%

5%

Journey

Baggage and personal

effects

Medical

Other

Source: EIOPA Travel Insurance thematic review

CONSUMER PROTECTION ISSUES IN TRAVEL INSURANCE: A THEMATIC REVIEW

23

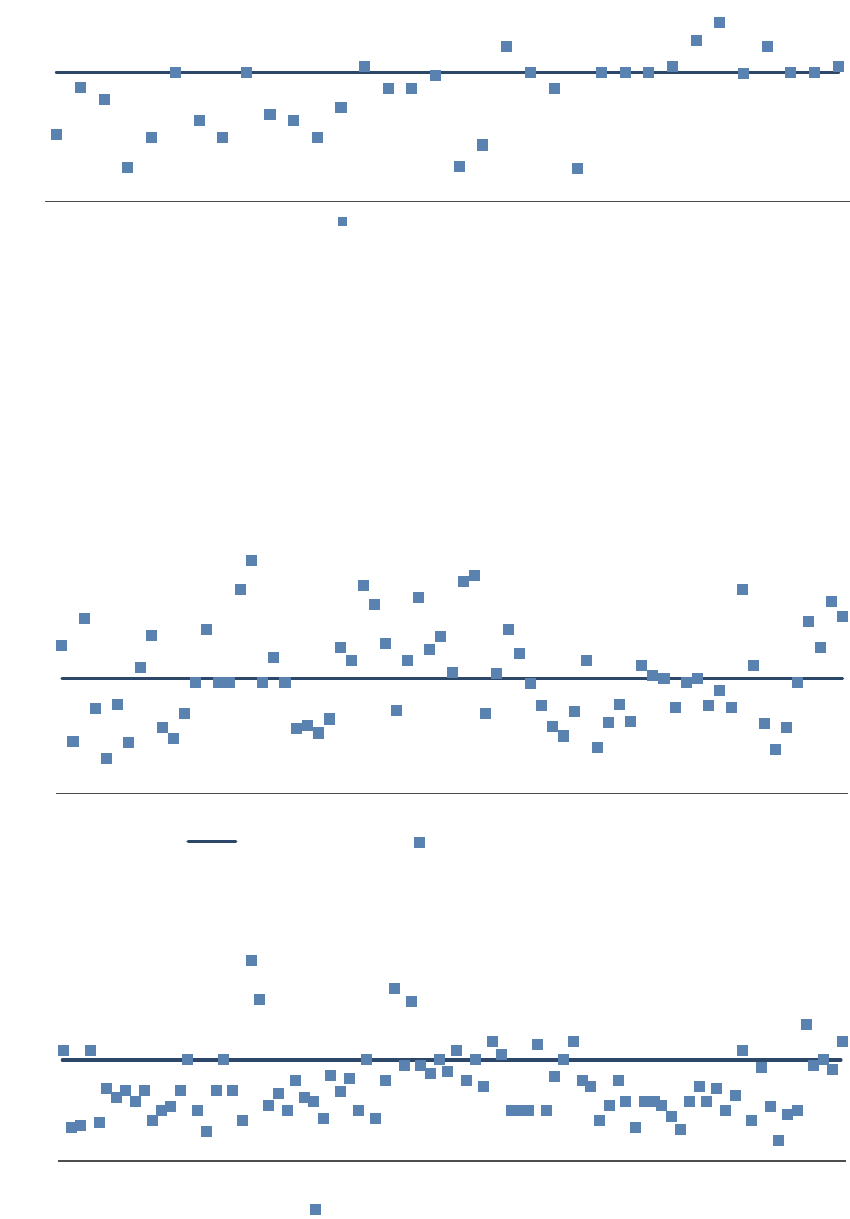

1.6. DENIED CLAIMS

Denied claims are those that have been submitted by

the policyholder and dully processed by the insurance

undertaking, which have ended without payment to the

policyholder. For the purpose of the thematic review, only

the claims that have been completely denied have been

considered. Claims partially denied were not considered

as claims denied.

Based on the data reported by the insurance undertak-

ings participating in the IQ, the total number of denied

claims accounts for 17% out of the total number of claims.

(Figure 26).

When looking at the spread of denied claims per distri-

bution channel, bancassurance (

18

) (34%) and ancillary

insurance undertakings (22%) account for more than half

of the total number of denied claims. This is in line with

the total collected GWP per distribution channel, bancas-

surance and ancillary insurance undertakings having the

highest share.

A more detailed analysis of the numbers of denied claims

out of total claims shows that:

¡ Out of 61 insurance undertakings that reported

the numbers of paid and denied claims for

bancassurance, for 28 the proportion of denied

claims out of total number of claims represents

more than the average of 17%. Moreover, for 11

of them the proportion of denied claims is above

30% of the total claims. Considering that the

travel insurance products sold via bancassur-

ance are mainly multi-trip policies (97% of the

GWP collected via bancassurance), this might

indicate that the coverage oered by some

policies does not fit consumer’s expectations

or that in some cases the terms and conditions

contain exclusions consumers are not aware of.

¡ With regard to insurance agents/ brokers out

of 75 insurance undertakings that reported the

numbers of paid and denied claims, for 25 the

proportion of denied claims is above the aver-

age of 17% of total number of claims and for 12

(

18

) The share of bancassurance in total denied claims might be higher if

to consider the data from one company that has a partnership with Visa.

The company reported the data under “other distribution channel” and

not under “bancassurance”. With regard to the share of “other distribu-

tion channel” in the total number of denied claims, there is one company

that has a partnership with Visa where its travel insurance products are

sold together with credit cards.

the proportion is above 30% of total number of

claims.

¡ In the case of comparison websites/ aggrega-

tors, out of 22 insurance undertakings that use

this channel and reported the numbers of paid

and denied claims, 11 insurers have proportions

of denied claims above the average 17% of total

number of claims and for 5 of them the propor-

tions are higher than 30% of total number of

claims.

Source: EIOPA Travel Insurance thematic review

Figure 27 – Proportion of denied claims per distribution

channel

16%

34%

16%

1%

2

2%

11%

Direct sales

Bancassurance

Insurance

agent/broker

Comparison

Ancillary insuranc

e

intermediary

Other distribution

channel

Figure 26 - Proportion of denied claims

83%

17%

Claims paid Claims denied

Source: EIOPA Travel Insurance thematic review

EUROPEAN INSURANCE AND OCCUPATIONAL PENSIONS AUTHORITY

24

¡ For ancillary insurance intermediaries, out

of 48 insurance undertakings that reported the

numbers of paid and denied claims, 18 insurers

have proportions of denied claims above the

average of 17% of total number of claims and 8

have ratios higher than 30%.

When talking about the number of claims denied per type

of cover, the denied claims related to the travel journey

have the highest percentage of the total denied claims

(44%). Medical claims account for 29% of the total denied

claims.

As highlighted earlier in the report this might be related

to the pre-existing medical exclusions that are excluded

from the cover but are not registered at the moment of

sale of the travel insurance product. As most of the partic-

ipants in the industry questionnaire do not use medical

screening before the signing of the contract, the pre-ex-

isting medical conditions are not taken into account when

selling the travel insurance policy.

A more granular analysis of the denied claims per cov-

erage shows that those insurers that reported having a

medical screening in place before contracting a travel

insurance policy have lower percentages of denied claims

for medical coverage of the total denied claims. This could

indicate a positive impact of the medical screening on the

number of the denied claims related to medical coverage.

With an upfront medical screening, consumers are able

to declare their health situation and pre-existing medical

conditions and the insurer is able to inform the consumer

on the oered coverage

However, the data does not show a strong correlation

between the medical screening and low rate of denied

claims for the medical coverage, so conclusions must be

tentative at this stage.

Without a medical screening, the needs of the consumer

with pre-existing medical conditions may not be fully

respected, as the coverage oered by the travel insurance

product is not tailored to their individual situation (see

Section 3.4 which presents how undertakings take into

account pre-existing medical condition and causes for

potential consumer detriment).

Figure 28 - Proportion of denied claims out of total

claims per cover

44%

16%

29%

11%

Journey

Baggage

and personal

effects

Medical

Other

Source: EIOPA Travel Insurance thematic review

CONSUMER PROTECTION ISSUES IN TRAVEL INSURANCE: A THEMATIC REVIEW

25

2. BUSINESS MODELS

Travel insurance related

business models vary sig-

nificantly based on the dis-

tribution strategy, product

features, and product

complexity. A business

model analysis on one

hand can help identifying

inherent conduct risk on

the other hand it can assist in understanding the impact

on digitalisation and underlying conduct risks.

2.1. CHANGES IN THE BUSINESS

MODELS

Despite a general digitalisation trend, the majority

of respondents (71%) when asked if they faced major

changes reported that no major changes have happened

in the recent years in the travel insurance market and in

the business models of the insurance undertakings.

The remaining 30% reported changes in relation to:

¡ Integrating new technologies to sell travel insur-

ance products (mobile applications and other

online distribution channels);

¡ The de-bundling of the travel insurance prod-

ucts from certain bank accounts to give custom-

ers the option to decide whether they would like

to buy the travel insurance or not.

¡ The development of tools allowing the custom-

ers to complete their end-to-end journey online,

including renewal, claims notifications and elec-

tronic notifications of loss.

One insurer mentioned in the questionnaire that there

are several Insurtech companies using new technologies

such as mobile GPS location to reach out to customers

when they are on holiday.

In fact, with changing consumer behaviours, demanding

better, easier and faster customers’ experience and more

personalized products, several incumbents are:

¡ Changing their travel insurance products (

19

);

and/or

¡ Changing their distribution strategies.

To adapt to new technologies, two insurance undertak-

ings reported outsourcing part of the business operations

to reach more customers and decrease administrative

costs.

(

19

) For example, one insurance undertaking reported its willingness to

develop new insurance products to dierentiate from other providers:

it has launched a new type of insurance for camping covering material

damages to the tent, expenses for temporary accommodation and third

party liability.

“

Some IU are

moving from

mainly direct sales

to selling online,

through compari-

son websites.

”

Figure 29 - Changes in Business Models

29%

71%

Yes No

Source: EIOPA Travel Insurance thematic review

EUROPEAN INSURANCE AND OCCUPATIONAL PENSIONS AUTHORITY

26

2.2. DIGITALISATION AND

INNOVATION - THE DRIVERS FOR

CHANGE

Technological innovations are beginning to change the

way the travel insurance market is operating. Benefits

and potential risks need to both be considered. As shown

in EIOPA’s recent thematic review on Big Data Analyt-

ics (

20

) while there are numerous benefits and opportu-

nities, risks should not be underestimated. Amongst the

specific benefits, it is noteworthy that:

¡ Consumers can increasingly buy travel insur-

ance alongside their online booking of flights or

train tickets.

¡ Web tools and mobile applications facilitating

customers’ experience and driving ecient and

optimal coverage are being developed.

¡ Purchasing online travel insurance can ena-

ble the consumer to access better information

about coverage and nudge consumers towards

paying more attention to the travel insurance

policy.

¡ The introduction of price comparison websites

is generating a more competitive field and pro-

moting comparisons.

(

20

) Big Data Analytics in Motor and Health Insurance, EIOPA – 2019

https://eiopa.europa.eu/EIOPA-reviews-the-use-of-Big-Data-Analytics

Innovation both in the insurance and tourism sector

are not the sole factor driving innovation with regard to

travel insurance products. Respondents highlighted that

consumers’ habits are also changing, with more and more

consumers switching from buying full travel package from

a tour operator to creating bespoke itineraries. Hence,

insurance companies noted that consumer’s awareness

about the need to be covered for unforeseen events while

travelling is increasing.

Finally, in a constantly ‘online environment’ more and

more customers’ segments, especially millennials, expect

to get serviced and communicate with insurers at any

time of the day. Respondents noted that quick and eec-

tive engagement with these consumers is crucial and the

development of new technologies – apps, web portals,

chatbots – is perhaps already making an eective contri-

bution.

CONSUMER PROTECTION ISSUES IN TRAVEL INSURANCE: A THEMATIC REVIEW

27

2.3. NEW DIGITAL DISTRIBUTORS

OF TRAVEL INSURANCE

Participants reported that transport companies with large

customer bases and direct customer interfaces, such as

airlines, have started to enter the travel insurance indus-

try, mostly as distributors. The business models used by

such companies are not only having an impact on the

insurance industry but can have a potential detrimental

impact on consumers (see Section 4.1.2 on commissions

and Section 4.3).

In fact, they often operate as business originators and lev-

erage their large customer base and market power when

setting the terms of the distribution agreement with

insurance undertakings.

Around 30% of respondents have worked with these

partners and reported some benefits relating to this busi-

ness model such as: enabling them to easily and rapidly

increase their customer base giving more access to travel

insurance as well as allowing them to integrate travel pat-

terns/travel behaviour data in their risk models.

However, they have also indicated that some of these

companies set upfront (unnegotiable) commission rates,

often more than 60% plus additional fees on exclusivity,

marketing, IT costs, etc. (

21

) This not only aects market

dynamics but also creates new sources of consumer det-

riment (see Section 1.4 on commissions) or increase the

scale of existing potential detriment.

(

21

) For example, one respondent reported that its average paid commis-

sion to OTAs are around 70%-75% of the written premiums.

BOX ONE RESPONDENT IN THE

INDUSTRY QUESTIONNAIRE

“We have taken part in an oer to sell travel insur-

ance to an airline company, we came second. We

also took part in a tender to provide credit card

travel insurance to a newly merged bank. They

had very strict requirements about the coverage

to be oered and it was made clear that price is

the key factor in deciding. It was also implied that

we could get creative with exclusions in coverage.

We came second again.”

Source: EIOPA Travel Insurance thematic review

EUROPEAN INSURANCE AND OCCUPATIONAL PENSIONS AUTHORITY

28

2.4. EMERGING BUSINESS

MODELS – BIG TECH ENTERING

THE MARKET

The increase in online distribution may be further

boosted as online travel specialists (

22

) play an increas-

ing role in distribution and if large technological/internet

companies (

23

) enter the travel insurance market, at least

as a first step, in distribution. Companies in other sectors

with a distribution network and a large pool of customers

(e.g. supermarket chains) are also potential contenders to

entering the market as intermediaries.

Players like Google, Amazon, Facebook and Apple

(GAFAs) are already providing financial services to their

customers and some have been starting to take steps

to enter the insurance market. (

24

) Due to their financial

capacity, large scale, trusted reputation, brand recogni-

tion and access to a large customer base and personal

data, they have the capacity to be important disrupters.

Rather than operating as conventional insurance interme-

diaries, new entrants may operate as business originators

and aggregators.

When answering whether new large entrants will change

the dynamics of the market and create new sources of

consumer detriment or increase the scale of existing

ones, respondents indicated that these changes are yet to

happen, but also articulated extensive concerns.

It was noted how new entrants would be in a strong posi-

tion to leverage their large customer base and market

power and squeeze business margins potentially at the

(

22

) E.g. Bookings.com, TripAdvisor, Expedia or Trivago.

(

23

) E.g. GAFAs (Google, Amazon, Facebook and Apple).

(

24

) E.g. Amazon Protect provides accidental damage insurance to prod-

uct bought via Amazon; Apple oers limited insurance for its own prod-

ucts via Apple Care; Google Compare, which was discontinued in 2016,

was an online comparison tool for, among others, car insurance.

detriment of the insurance sector and/or consumers. In

addition, as already noted, they may also be able to set

the terms of distribution agreements with insurance

undertakings by setting upfront commission rates when

putting up their ‘distribution business’ for tender among

competing insurance undertakings.

In EIOPA’s thematic review on Big Data Analytics, a spe-

cific part was dedicated to how Big Tech firms could enter

the insurance market. In the questionnaire circulated to

the industry,

“the majority of respondents stated that

they have observed an increasing interest of some Big

Techs in entering the insurance market.”

(

25

)

Respondents to the current thematic review broadly

endorsed the same picture: Big Tech firms have an unu-

sually large customer base and access to large amounts

of dierent types of data, which are not available to tra-

ditional insurance companies. Should Big Techs decide to

enter the insurance market, many insurance firms consider

that this would take place in the form of intermediaries /

brokers / price comparison websites; they consider that

they could disrupt the distribution of insurance products

by selling insurance products through their platforms.

This is even more relevant for the travel insurance mar-

ket since online price comparison websites are already in

place selling travel insurance products.

Participants in both questionnaires indicated that large plat-

forms with strong bargaining power could define the ‘rules

of the game’ by favouring certain products in the ranking

criteria of their platforms or by controlling the entities that

can sell products through their platforms.

(

25

) Big Data Analytics in Motor and Health Insurance, EIOPA – 2019

https://eiopa.europa.eu/EIOPA-reviews-the-use-of-Big-Data-Analytics

CONSUMER PROTECTION ISSUES IN TRAVEL INSURANCE: A THEMATIC REVIEW

29

2.5. RISKS FOR DISTRIBUTORS

NOT INTEGRATING NEW DIGITAL

MODELS

Digitalisation has already started transforming the travel

insurance market. With new digital distributors acquiring

parts of the markets, traditional distributors might be

impacted by the new developments.

As reported by the insurance companies in the IQ, those

insurance distributors that will not adapt to the new envi-

ronment and will not integrate the new technologies in

their distribution models might face some challenges and

risks.

¡ The main risks highlighted by the respond-

ents are the risk of losing potential customers

and the risk of reduction in market share. Due

to changes in consumer behaviour and buying

preferences, distributors that do not integrate

new technologies and do not implement digital

distribution channels will not be able to survive

in an environment of market consolidation. They

may experience significant drop in sales and

face issues around decreasing profitability and

business sustainability.

¡ Traditional distributors risk becoming too

expensive for customers that buy similar travel

insurance products online, therefore, they

might have to lower their commission levels in

order to maintain contracts and business rela-

tions with insurers. Traditional oine agencies

require investments in sales animation and mar-

keting campaigns, which are key for stable sales

but that can become very costly.

¡ In the era of digitalisation and development

of online sales, it is anticipated that traditional

distribution channels (brokers, tied-agents, call

centres) will gradually disappear.

¡ The traditional geographic broker or the niche

provider often does not have the same market-

ing and digital customer journey expertise as

Insurtechs. This means they cannot reach cus-

tomers in a cost-eective way, or their websites

do not appeal on mobile channels compared to

the new, responsive designs.

¡ Finally, the insurance distributors that would

not use digital channels to sell travel insurance

may have to identify niche markets fulfilling the

needs of a specific target market.

EUROPEAN INSURANCE AND OCCUPATIONAL PENSIONS AUTHORITY

30

3. IDENTIFIED ISSUES IN PRODUCT DESIGN

All types of travel insurance were within the scope of the

thematic review except for products covering long uninter-

rupted stays abroad, given their unique purpose and char-

acteristics, in particular with regard to the specific cover

they oer (in most cases limited to explicit medical costs).

3.1. PRODUCT COMPLEXITY

Insurance is, in general, a complex area for consumers to

understand.

The design of travel insurance products might increase

the level of complexity when compared to other similar

types of insurance. Significant variations exist regarding

the type and the level of coverage and applicable restric-

tions and exclusions. Travel insurance policies can include

various coverages like medical expenses, private liabil-

ity, personal accident, trip cancellation, loss of baggage,

etc. For instance, a medical condition that is excluded in

one policy might be included in another (

26

). This level of

(

26

) Especially for consumers with pre-existing medical conditions, this

may be dicult since the conditions on and the result of a prior approval

can dier from undertaking to undertaking.

diversity is indicative of a high level of complexity in the

market.

Product complexity has an impact on consumers’ ability to

fully understand the product in particular with regard to the

level and extent of cover. Terms and conditions may also

be complex and dicult to understand, in particular with

regards to the use of technical medical terms linked to med-

ical coverage (and exclusions). This in addition to the con-

text and manner in which travel insurance policies are sold.

High complexity makes it dicult for consumers to nav-

igate the market, compare coverages and prices and find

the insurance policy that best fits their needs.

The majority of respondents to the IQ indicated, however,

that from their perspective, travel insurance products do

not have a high level of complexity and that the products

are not assessed for complexity. Moreover, most of the

respondents reported that no restrictions on selling spe-

cific travel insurance products are applied when it comes

to distribution channel or type of customer.

BOX COMPLEXITY OF TRAVEL INSURANCE POLICIES

The complexity and diversity of products available on

the market can also be a source of detriment for con-

sumers. Customers expect travel insurance to cover any

eventuality. However, the reality is that no two policies

are alike, and travel insurance policies often comes with

strict limitations and exclusions as to the type of cover

that is provided and the amount an insurer may have to

pay. Consumers’ organisations therefore frequently warn

consumers to carefully consider the fine print to under-

stand which risks are covered. The extensive usage of

exclusions in contracts can contribute to product com-

plexity for consumers and impede their ability to suc-

cessfully navigate and compare the market. This is also

complicated by the fact that the terms and conditions

of insurance policies are not always straightforward. For

instance, a recent Which? study (

27

) found that insurance

policy document can be so hard to understand that uni-

versity-level reading abilities may be required to make

sense of them and even industry experts struggle to

cut through the jargon. Our Austrian Member Arbeiter-

kammer found that even subtle language dierences in

the terms and conditions of travel insurance policies can

have a significant impact on whether an individual will

be covered by the policy or not. (

28

)

Source: BEUC

(

27

) Which?, Crime and punishment: insurance policies complex and full

of jargon. https://press.which.co.uk/whichpressreleases/crime-and-pun-

ishment-insurance-policies-complex-and-full-of-jargon/

(

28

) Arbeitkammer, ‘Reisestornos – Blick ins Kleingedruckte lohnt sich’, https://

www.arbeiterkammer.at/beratung/konsument/Reise/Reisestornos.html

CONSUMER PROTECTION ISSUES IN TRAVEL INSURANCE: A THEMATIC REVIEW

31

3.2. TERMS AND CONDITIONS-

TRANSPARENCY AND

DISCLOSURE

On average around 17% of the complaints consumers

make, are related to the terms and conditions of a travel

insurance policy. This indicates that there might be some

issues on how terms and conditions are disclosed and

explained to consumers. (see Section 5 on complaints).

Providing clear and transparent information to customers

is key. Moreover, consumers tend to pay very little atten-

tion to what is indicated in the terms of an insurance pol-

icy. The responsibility is shared between the insurers and

distributors on one side, making sure that they put eorts

into explaining them and on the consumers on the other

side, making sure that they acknowledge and understand

the products as well as the terms and conditions.

¡ A large majority of insurance undertakings par-

ticipating in the questionnaire reported that

terms and conditions of their travel insurance

products are available and presented to the con-

sumers before contracting a policy.

¡ In most cases, terms and conditions are published

on the websites and available for download.

Depending on the distribution channel the terms

and conditions are shared with the customers in

electronic or in paper form, by email or by post.

¡ Respondents mentioned initiatives like bro-

chures, factsheets and flyers that present infor-

mation on the travel insurance products in ‘clear

and simple’ language. Moreover, a comprehen-

sive and user-friendly product explanation is

available on some insurers’ websites that explain

the scope of coverage oered by a product.

¡ One respondent mentioned that along the terms

and conditions, consumers receive a file with fre-

quently asked questions (FAQs), a detailed bene-

fits table and a summary with the policy wording.

¡ In view of the application of the Insurance

Distribution Directive (IDD), two respondents

reported in the IQ, the use of the Insurance

Product Information Document (IPID) (

29

)

already in 2017. The IPID provided to customers

(

29

) Under the Insurance Distribution Directive (IDD), consumers bene-

fit from a simple, standardised insurance product information document

(IPID), which aims to provide clearer information on non-life insurance

products, so that consumers can make more informed decisions.

details on the key features of the product,

exclusions, limitations and coverage.

As a general measure, prior to the contract conclusion,

some respondents ask the customers to confirm that it

has received sucient information about the insurance

contract and the insurance contract complies with its

needs and requirements.

However, there are cases where the terms and conditions

are not very clear and do not provide the adequate infor-

mation. For example, when it comes to trip cancellations,

in some cases insurers do not provide details with regard

to accepted reasons for cancellations. Some insurers may

not specify in the terms and conditions of the travel insur-

ance policy in which cases the trip cancellation will not be

covered by the policy. The use of general terms like “force

majeure” or “serious illness” without give concrete details

on these situations can raise confusion for the consumer.

BOX ISSUES RELATED TO TERMS

AND CONDITIONS

Trip cancellation insurances mostly have a clause

which includes “unexpected serious illness”

(“unerwartet schwere Krankheiten”) as reason for

trip cancellation. However, insurer X did not explain

in its terms and conditions which illness could be

considered as “unexpected” as well as “serious” (e.g.

pneumonia or influenza). That is why BdV consid-

ered this clause as non-transparent and therefore

not applicable and went to court.

Only shortly, after this action, the Association

of German Insurers (GDV) asked BdV for a

settlement of dispute resulting in a press release

amending the standard policy.

The amendment consisted in providing an addi-

tional explanation of the criteria of “unexpected”

and of “serious” with regard to illness by elucidat-

ing several examples. Although these standard

policy conditions are non-binding, the insurer X

included these additional explanations in its terms

and conditions for the new trip cancellation con-

tracts. The court has not yet decided with regard

to the previous similar cases.

Source: Bund der Versicherten (BdV)

EUROPEAN INSURANCE AND OCCUPATIONAL PENSIONS AUTHORITY

32

3.3. PRODUCT DIVERSITY AND

PRODUCT STANDARDIZATION

Product diversity and/or tailor-made products may be

advantageous for consumers since these products may

be able to better meet specific needs to a greater extent

than standardized products. On the other hand, product

diversity may enhance the complexity of those products

and make them dicult to compare.

(Apparent) product standardization also bears the risk of

consumers being under or over-insured if available prod-

ucts either do not meet their specific needs or have cov-

erage (and costs) above the customers’ needs. The risk of

a lack or of underinsurance is especially relevant for hold-

ers of annual policies. These policies tend to have little

or no possibility of adjusting the terms during the life of